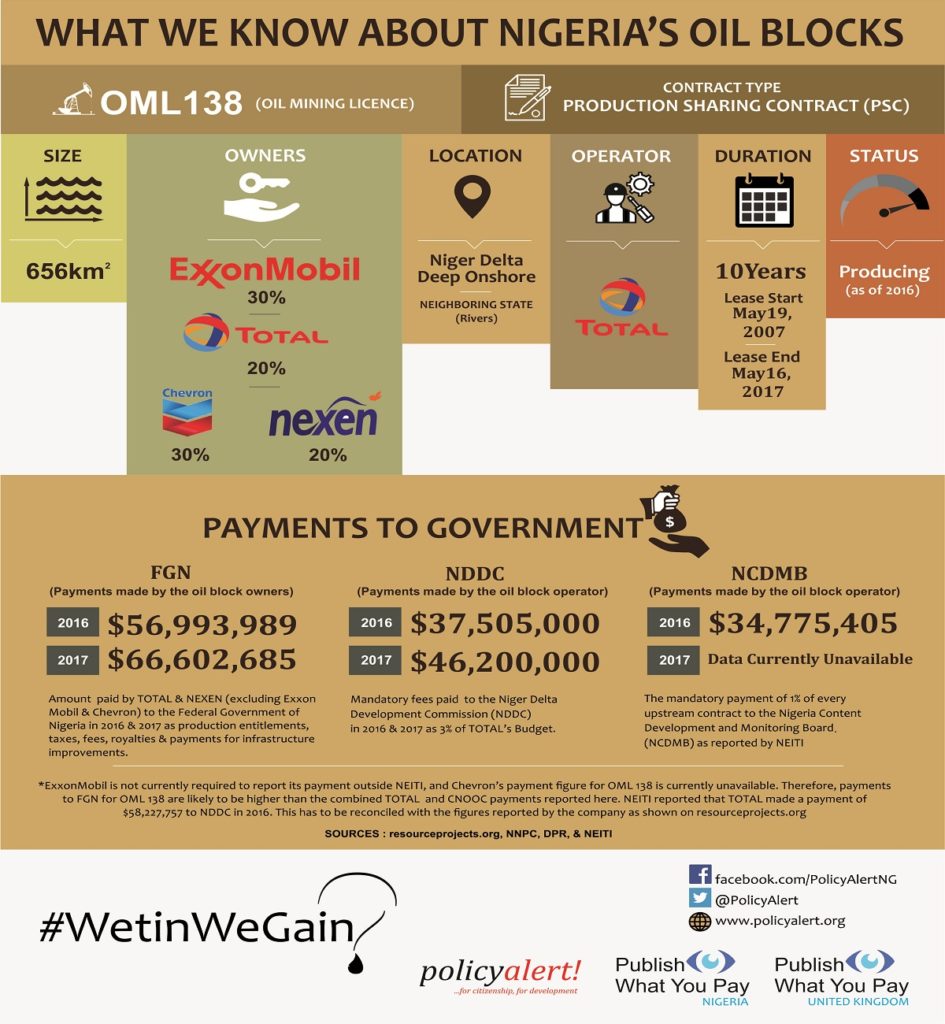

According to the 2017 Nigerian Oil and Gas Industry Annual Report of the Department of Petroleum Resources (DPR), ExxonMobil and Chevron each own 30% of OML 138, while Nexen and Sinopec each own 20% of OML 138. The aforementioned report also states that OML 138 is operated by TOTAL.

The OML 138 block contains the Usan field which started production in February 2012. Usan began producing in February 2012 and is expected to reach peak production of approximately 180,000 barrels per day. Estimated proven and probable reserves are more than 500 million barrels.

In November 19, 2012, TOTAL announced that it had agreed to sell its 20% stake in OML 138 to SINOPEC for $2,500,000,000 in cash, subject to approval by the Nigerian government. The sale eventually fell through without any reason given by TOTAL.

In 2014, Total hired BNP Paribas to find buyers for its 20% stake in OML 138 which it failed to sell to Sinopec in 2012. Total needed to quickly dispose of its stake because high-cost projects such as OML 138 cut into corporate profits and the lower oil price hits at the bottom line as well.